Economic review of 2023: 5 key takeaways

The Bureau of Labor Statistics released preliminary December data on the state of the local economy last week. This release provides an opportunity to review the data from throughout 2023, and how it compares to last year as well as pre-COVID.

Here are five key takeaways:

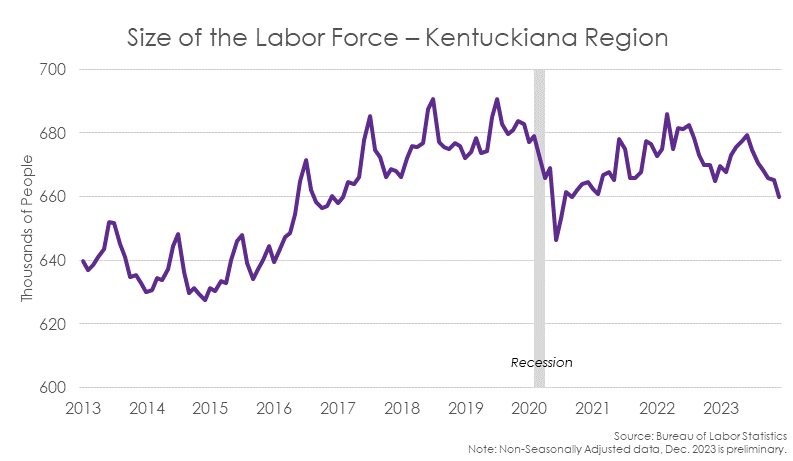

1. The average size of the labor force was about 1.5% smaller in 2023 than it was before the pandemic.

After falling precipitously during the height of the COVID-19 pandemic, the region’s labor force appeared to rebound in the first and second quarters of 2022. At that time, the region experienced a labor force that was slightly larger than its level at the same time in 2019.

However, this trend did not hold. The third quarter is typically the peak of the labor force size, but in 2022, the labor force shrank in the third and fourth quarters.

2023 appeared to start a reversal of the trend, with the labor force again growing in the first and second quarters. However, once again, the size of the labor force declined in the third and fourth quarters of 2023. The average size of the labor force was about 1.5% smaller in 2023 than it was before the pandemic. This amounts to over 9,000 people.

Definition review - Labor force

The size of the labor force accounts for the pool of potential workers in the region. It includes people who are working as well as people out-of-work, but actively seeking work over the last month. It counts individuals just one time, even if they have multiple jobs. It counts people who report working, even if that employment is self-employment or contract-based work. It does not count people who have not actively looked for work over the last four weeks.

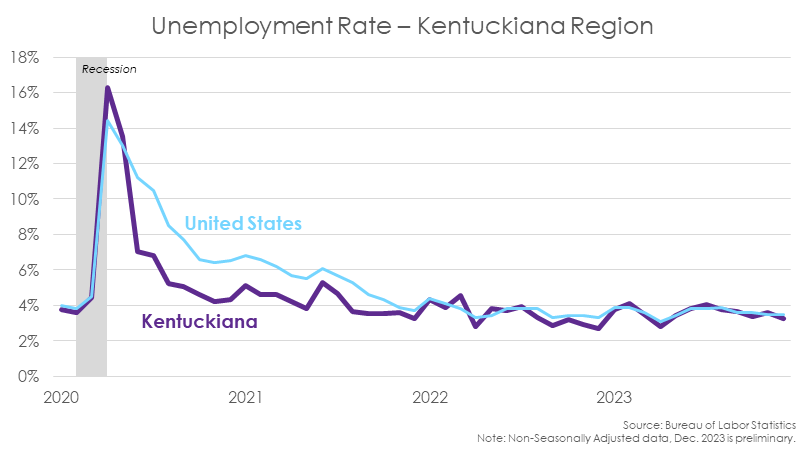

2. The unemployment rate remained low throughout 2023, even though it was slightly higher than the rates experienced in 2022.

The region’s unemployment rate stayed below 4.1% in 2023, marking another year of very low unemployment. The region’s unemployment rate tracked closely with overall US unemployment for the last two years. Both the Kentuckiana region and the US averaged an unemployment rate of 3.6% throughout 2023.

Even so, the unemployment rate in 2023 was slightly higher than in 2022, which averaged 3.5% throughout the year. In the last seven months of 2023, the unemployment rate was higher as compared to the same month in 2022.

Definition review - Unemployment rate

The unemployment rate measures the percentage of the people in the labor force who are out-of-work. When the unemployment rate is low, it signifies that people who are looking for work are likely to be employed.

3. There were fewer employed workers in 2023.

Because the unemployment rate is a function of the size of the labor force, it is important to understand how changes in one affect the other. Because the size of the labor force has been shrinking while the unemployment rate remains low, there must be fewer employed workers in the region. There were more than 8,000 fewer people reporting employment in 2023 than before the pandemic.

Definition review - Employed persons

Employed workers accounts for all of the people who are actively working in a given month. It counts individuals just one time, even if they have multiple jobs. It counts people who report working, even if that employment is self-employment or contract-based work. Employed persons make up part of the labor force.

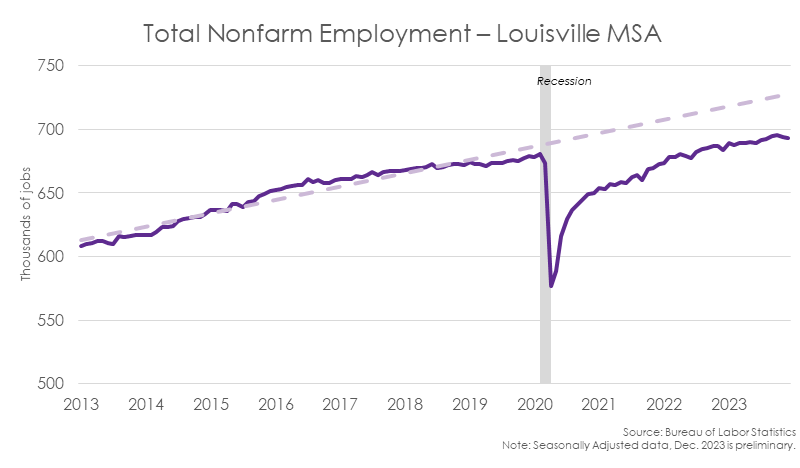

4. The number of jobs on payrolls increased in 2023, but is still below pre-COVID trend.

The region recovered all of the jobs lost during the COVID-19 recession by the third quarter of 2022. Throughout 2023, the region continued to add jobs to the payrolls. Total nonfarm employment was 1.5% higher in 2023 over 2022, amounting to more than 10,000 jobs added over the course of the year.

Even so, the number of jobs in the region is still below the trend in job growth experienced after the Great Recession.

Definition review - Nonfarm Employment

Total nonfarm employment counts the number of jobs on company payrolls. It counts people with more than one job multiple times, as each job is counted. It does not include employment data for those outside company payrolls, including the self-employed and independent contractors. The smallest geography available is for the metropolitan statistical area (MSA).

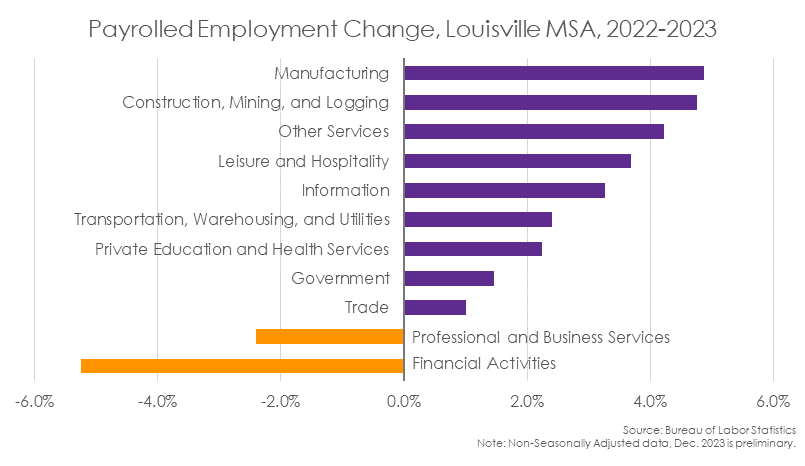

5. Manufacturing and construction realized the fastest job growth between 2022 and 2023.

Although employment in manufacturing was slower to recover in 2021 and 2022, the sector appears to have made up for lost time in 2023. Manufacturing experienced the fastest job growth over the year, growing by 5% and adding over 4,000 jobs in 2023. The construction, mining, and logging sector was not far behind manufacturing, also growing by 5% over the year. On the other hand, employment levels in the professional and business services and financial activities sectors declined in 2023.